|

Low-income H.O.M.E. buyers up $1 million on house gains, yet charity and county hit by Brock & HUD over red tape

HUD is requesting county repay $427,472 federal grant

By Gina Edwards

Naples City Desk

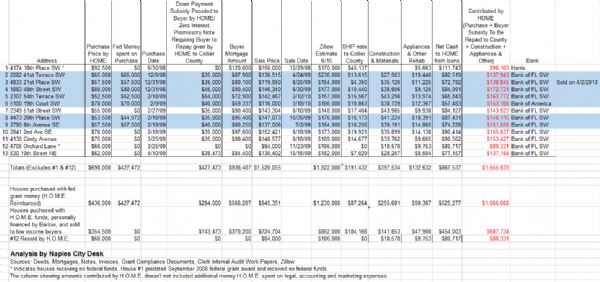

In the business world, the results would be applauded: The low-income families who purchased from the charity H.O.M.E. have houses today worth almost $1 million more than the monthly mortgages they owe.

If the low-income buyers were to sell the houses today, they would be required to pay back all the government subsidies they received from federal and state money —including a $427,472 federal pass-through grant that Collier County received from HUD.

And if they were to sell today, the low-income buyers would still be in the black by $400,000, based on a Naples City Desk analysis of Zillow value estimates for the houses.

The government would get back all its money.

And the low-income buyers would make $400,000.

But elected Clerk of Courts Dwight Brock, lobbying HUD officials last year — about the now seven-year-old grant — told federal housing officials that he was concerned the low-income buyers are victims. He said buyers were “potentially victimized” because the mortgages and notes exceeded the appraised values of the houses when they were purchased.

Officials from HUD’s Miami office appear to be persuaded by Brock based on a letter to Collier County sent June 8, 2015 that asks the county to pay back all $427,472 the county spent on the H.O.M.E. grant. In its recent letter, HUD said “Our review of appraisals disclosed that mortgages exceeded appraised value.”

Appraisers, though, submitting the reports wrote that values in the area were depressed because of the amount of foreclosures at the time.

Now house values are bouncing back.

The notes are worth money —$427,472, or the total amount of the federal grant.

The notes were designed to do something government rarely does: Recoup investment. Repayment of the zero-interest notes is due in 30 years or whenever the house resells, whichever is sooner. So, if the buyers flip the houses at market value, they have to pay back the notes that secure the charitable and government benefit they received.

The 11 blighted houses purchased and rehabbed by H.O.M.E. collectively are now worth almost $1.9 million based on Zillow estimates reviewed by Naples City Desk, or almost $1 million more than the low-income buyers owe on their monthly mortgages.

Those estimates likely don’t capture the added property value of the extensive remodeling work H.O.M.E. did to fix up the foreclosed and blighted houses. The houses H.O.M.E. bought to fix up and resell had code violations and damage and they received extensive remodels with new kitchens, roofs, baths, A/C units, flooring, appliances and other upgrades.

H.O.M.E., with permission from county staff, had planned to use proceeds to keep its home buying/rehab/reselling program for low-income buyers going. But the foreclosure crisis erased need for affordable housing and after H.O.M.E. shut down in 2010, it assigned the notes to Collier County so the county can collect.

Brock told Naples City Desk last year that H.O.M.E.’s assignment of the $427,473 in notes to Collier County didn’t count as a return of income to Collier County because Collier Commissioners hadn’t voted to officially accept the notes. In his letter to HUD, Brock wrote that H.O.M.E. attempted to assign the notes to Collier County “with no evidence of acceptance.”

One of the H.O.M.E. houses was resold in 2013, according to Zillow listings reviewed by Naples City Desk, but it does not show up as sold in Clerk of Courts Official Records.

|

Click to View Detailed Analysis by

Naples City Desk

Use Control at Top Right

to Zoom In & Out

|

The $427,472 in notes are an asset and Brock is the county’s official accountant and custodian of funds.

An investigation by Naples City Desk in 2014, “Good Deeds: Punished,” found that Brock’s staff urged county officials to not accept the notes from H.O.M.E. in 2011 and pull a vote to accept the notes from Collier Commissioners’ agenda.

H.O.M.E. was founded by John Barlow, the retired CEO of Safelite Glass Corp., the largest auto glass specialist in the country. Barlow personally financed the purchase of five houses for H.O.M.E. and he secured private donations including some granite countertops for the low-income buyers. Think Extreme Home Makeover.

|

H.O.M.E. bought this foreclosure house in Golden Gate for $65,000 with federal grant money, remodeled it, and then sold it to a low-income buyer for $136,000 in April 2009. The buyer is making monthly payments on an affordable $87K mortgage. Zillow says the house is now worth $236,000.

|

H.O.M.E. Board member Gina Downs ran in 2010 against Collier Commissioner Georgia Hiller, who at that time was a Brock ally. Exasperated with the red tape and what he considered a harassing audit, Barlow ran for office against Brock in 2012.

Barlow and Downs filed a successful complaint with Florida’s Commission on Ethics against Collier Commissioner Tom Henning that resulted in a $500 fine for Henning in 2013. Brock re-opened an audit of H.O.M.E. a month later.

Now, Henning is asking his fellow Commissioners to vote on Tuesday to ask the county attorney to investigate suing Barlow and other board members of H.O.M.E., which had an all-volunteer board and no paid staff and is no longer operating.

Barlow and his attorneys say actually H.O.M.E. board members are the victims of a political vendetta by Brock. H.O.M.E. attorneys sent a letter to HUD officials in Washington saying Barlow and H.O.M.E. board members have spent a great deal of money and time defending themselves against a false smear campaign by Brock.

Brock claimed vindication in a press release he sent out following HUD’s letter from its Miami Office requesting that the county return $472,472 saying he raised the issues now being raised by HUD.

Correction: An earlier version of this story stated that one of the H.O.M.E. houses, with a $35,000 note assigned to Collier County, sold in 2013 based on Official Records. The sale is listed on Zillow, but not in the Official Records kept by the Collier Clerk of Courts.

Reporting By: Gina Edwards

Date: June 22, 2015

Contact Gina Edwards at ginavossedwards@gmail.com or by phone at 239-293-3640.

|