|

Clerk of Courts Dwight Brock and Sen. Garrett Richter signed agreement Friday to transfer county’s $600 million investment portfolio to different bank without vote of Collier Commissioners

By Gina Edwards

Naples City Desk

Collier Clerk of Courts Dwight Brock and Florida Sen. Garrett Richter signed an agreement on Friday to transfer custody of Collier County’s estimated $600 million investment portfolio to a different bank —without a vote of Collier Commissioners who approved a different entity as part of the controversial banking services contract voted on in September, Naples City Desk has learned.

A document obtained by Naples City Desk on Monday shows Brock and Richter signed an agreement on Friday, Nov. 14, 2014, to hand over custody of the county’s estimated $600 million portfolio to a Louisiana-based entity called First National Bankers Bankshares — not to Infinex Financial Group, the entity voted on by Collier County Commissioners and named in the banking contract signed by Commission Chairman Tom Henning on Nov. 1.

“It’s crazy,” said Commissioner Georgia Hiller, reached late Monday. “Dwight just can’t go out and transfer money to someone…The contract doesn’t say the custodian is anybody First Florida Integrity Bank picks.”

Hiller said the county’s investment policy requires Collier Commissioners to approve the custody agreement and this new entity was never part of the original bid.

“There has been no solicitation of that company,” Hiller said. “I can’t believe this is happening and no one is saying anything. I have never seen anything like this. Ever.”

Brock and Richter couldn’t immediately be reached for comment.

Brock unilaterally awarded the county’s lucrative banking services contract to the bank founded by Richter, First Florida Integrity Bank, and later Collier Commissioners by a narrow 3 to 2 margin voted to waive bidding irregularities after the fact and sign on as a party to the contract.

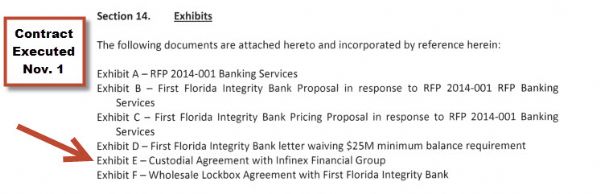

Commission Chairman Tom Henning executed the signed contract with the bank founded by Richter, First Florida Integrity Bank, on Nov. 1, 2014 and County Attorney Jeff Klatzkow signed off on the contract for legal sufficiency. Brock and Richter also signed the contract.

Commissioner Donna Fiala, who initially voted with Hiller and Commissioner Fred Coyle to re-bid the banking contract under the county’s purchasing ordinance – not Brock’s looser ordinance – switched her vote on Sept. 23 saying she would do so if the Board of County Commissioners was a party to the contract.

The signed contract, which is included in back-up documents online on today’s County Commission agenda, lists an “Exhibit E” for the contract as “Custodial Agreement with Infinex Financial Group.” But a signed custody agreement obtained by Naples City Desk on Monday transfers custody of the county’s securities to a Louisiana-based entity called First National Bankers Bankshares.

Brock’s Office provided a copy of the signed custody agreement on Monday after more than three weeks of delays in responding to public records requests by Naples City Desk, which first asked for a copy of the signed agreement with Infinex on Oct. 22. Brock spokesman Robert St. Cyr responded on Oct. 28, that Brock didn’t “currently have a ‘signed and executed’ custodian agreement with Infinex Financial Group as requested.”

A follow-up public records request that same day for any executed custody agreement, was answered by St. Cyr on Monday, Nov. 17.

Collier County’s master banking agreement with Fifth Third Bank expired on Nov. 1, 2014.

The agreement signed by Brock and Richter is labeled a “Supplemental Safekeeping Activity Services Agreement.” The document makes clear it establishes an account for custody of the county’s securities.

In response to public records requests, Commissioner Henning told Naples City Desk on Friday he didn’t have a copy of the executed custody agreement with Infinex. Earlier on Monday Henning said he didn’t have any custody agreement.

Collier Commissioner Georgia Hiller has raised questions about the banking contract and accused Brock of illegally steering the banking contract to Richter’s First Florida Integrity Bank. Brock and Richter have denied all wrongdoing. Henning has defended Brock.

At the last county commission meeting on Oct. 28, Henning defended Brock’s selection of Infinex Financial Group as the custodian for the securities.

Hiller contends that First Florida Integrity Bank was allowed to lower its bid after the fact by Brock: First Florida Integrity Bank removed a $25 million balance requirement that it had put in its bid response after all the bids were open. Hiller also contends that First Florida Integrity Bank failed to submit a responsive bid because it didn’t offer a trust company to serve as custodian as the county’s $600 million securities portfolio, didn’t offer a custody agreement, and instead offered up a broker dealer as custodian.

A blank account opening document with broker-dealer Infinex Financial Group was submitted to commissioners as the “custodial agreement” as part of the Sept. 23 vote by commissioners.

Richter has said First Florida Integrity Bank was selected because it offered the lowest cost to taxpayers on banking fees. In terms of cost, First Florida Integrity Bank bid fees for the county at $360,000 over the life of the contract versus more than $1 million bid by Fifth Third.

However, Fifth Third said in its protest that doesn’t capture the full picture:

Fifth Third estimated that based on historical performance it would provide the county with $850,000 more in interest income on its deposits than First Florida Integrity Bank. Fifth Third based this estimate on its use of the LIBOR versus the federal funds rate proposed by First Florida Integrity Bank.

Dateline: Naples, Fla., Nov. 18, 2014

Contact Gina Edwards at 239-514-1336 or by email at ginavossedwards@gmail.com

|